Many individuals have the wrong attitude concerning the loan procedure. They see the need to utilize your own loan or a payday loan as a bad thing. However, loans are not bad; they are part of reality and outstanding resource for when you actually need financial help. The situation with utilizing these loans will the incorrect destination to buy them. Which is why it is vital to understand the right and wrong approach to take about finding your own loan loan provider. The rules in this article will assist you to do that.

Exactly what a loan provider takes as collateral may depend on what type of lender they’re. If you should be having your loan from a bank, they might be much more more likely to accept your home or car as collateral as opposed to jewelry. However, if you head to a pawn shop or something similar, they might accept jewelry as it might be a short-term loan. Usually if a house is used as security it is considered a home equity loan or a second home loan payday loan.

With respect to the size and type of loan, often borrowers are rejected simply because they don’t have any decent security, or valuable property, to secure the loan. A secured loan is backed up by home, often real-estate or a late model vehicle, so if the borrower default, the financial institution can seize the house and sell it to cover the cost of the loan. Some types of collateral aren’t even worthwhile considering. If you had bought a $2,000 plasma display tv and provide it as protection, that tv is going to never be well worth half of that after a year; it really is of very little value to your loan provider as security.

Lately payday Loan businesses ‘ve got a bad rap about the interest they charge. Payday loan businesses charge the interest price that they do, because the only guarantee they have that you’ll pay your make by signing a check. Individuals can close checking records and their payday loans need certainly to head to collections where payday apr For a Personal loan individuals get just some of the amount due. The high interest would be to protect the investment associated with the loan company.

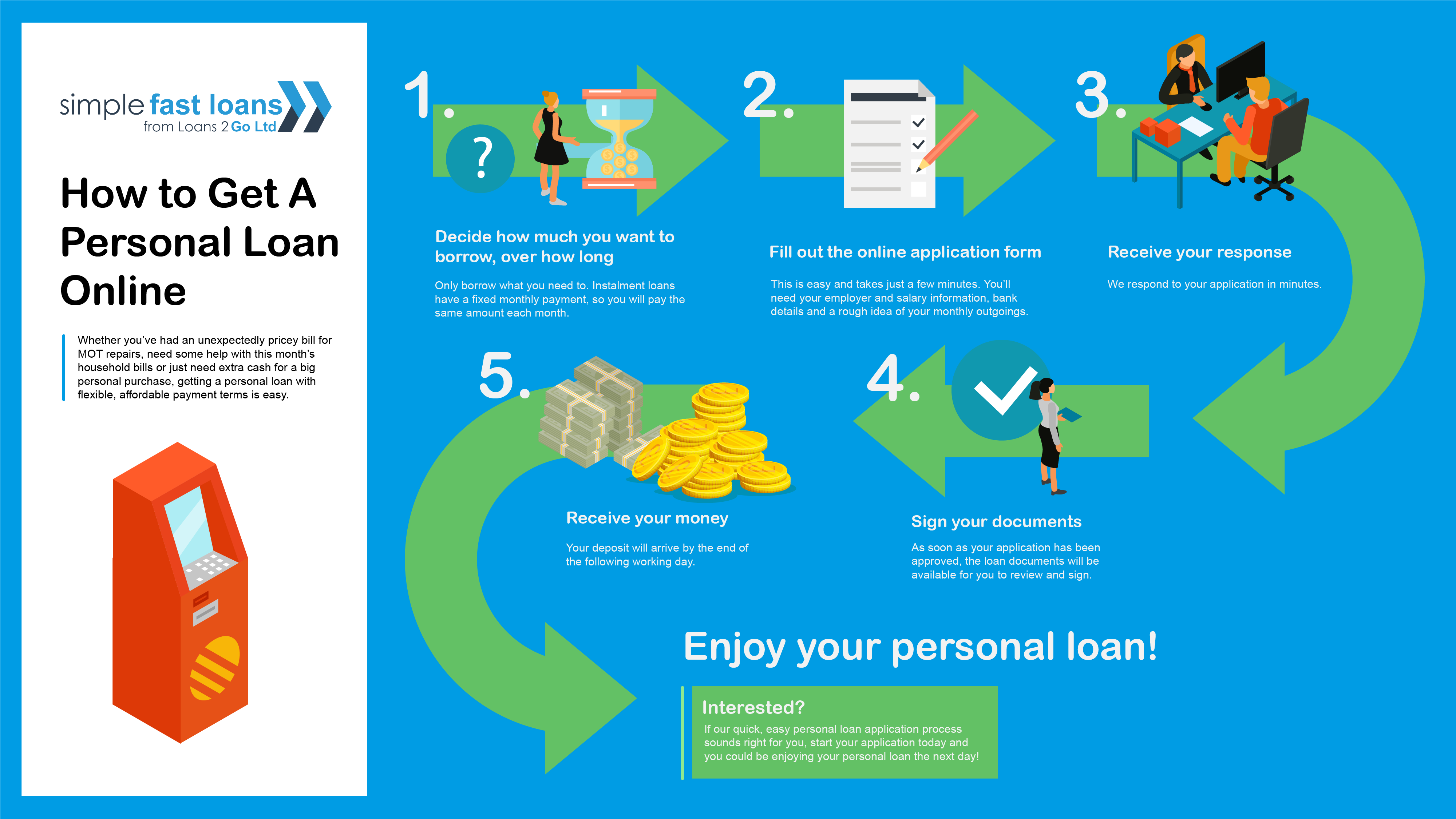

How exactly does it work, exactly? For on line applications, the lenders will process it when they obtain it and decide if you’re qualified. There are lots of personal loan providers who boast a 99per cent approval rate. When they approve the application, some body will give you a call or send you a contact to inform you concerning the prices therefore the regards to payment. You need to offer authorization for direct debits so they can get back the funds on due date. When all that is done along with consented to the terms they set, the funds is wired directly to your bank account.

One does not have to worry and prepare for a tear-jerking tale of needing money and all those material. No persona woes whatsoever is likely to be forced right out of the applicant: the private life is and will be treated as personal and will also remain in that way. This is in great reverse whenever you individually borrow from immediate family members or family members, or especially buddies. With this particular type of loan, it will just be business, basically.

With all the advent of the internet a payday loan application may be made online in minutes. If you undertake the loan application in the business workplaces you should have the reassurance of once you understand they’ve your application and are assessing it.

When there is a web site where you could check on the loan’s progression sporadically, this may be beneficial also. Paying attention and staying together with the situation could help you preserve both your credit report and the relationship.