We have some email messages from folks who are really up to their eyeballs indebted. One question we have expected repeatedly is, “Should we get your own loan to settle our bank cards?” Each situation is significantly diffent.

Consolidating your student personal loan debt may do more than just lower your long-lasting financial obligation. Truth be told that consolidation could help increase your credit rating throughout the loan. This, consequently, will help you purchase an improved automobile, obtain the home you would like, or get a lowered rate charge card. But how do a debt consolidation pupil loan will allow you to increase your credit? Consider some of the measures used by credit score agencies reporting.

Begin doing some research into various payday loan solutions. Find those who are reputable, and which have the greatest financing rates. Narrow it right down to some financing solutions that you would feel at ease dealing with. Consider both lenders in your local community, and on line lenders. Go online for reviews off their customers to aid find the best lenders. Keep the rate of delivery your money can buy at heart too, since some individual loan services could be faster than the others.

One of the better ways to repay the pupil fast and easy loan approval financial obligation is through going for debt consolidation reduction. With the aid of the consolidation programs you are able to save your self from different varieties of problems. There are people who tend to be defaulters by maybe not making the monthly premiums on time.

A fast method to get the loan is use the internet and punch within zip code additionally the kind of loan you need. You are getting an array of loan provider prepared to assist you. You might want to check online personal finance discussion boards to start to see the experience of other people. The greater company Bureau is a good spot to check on payday loan providers.

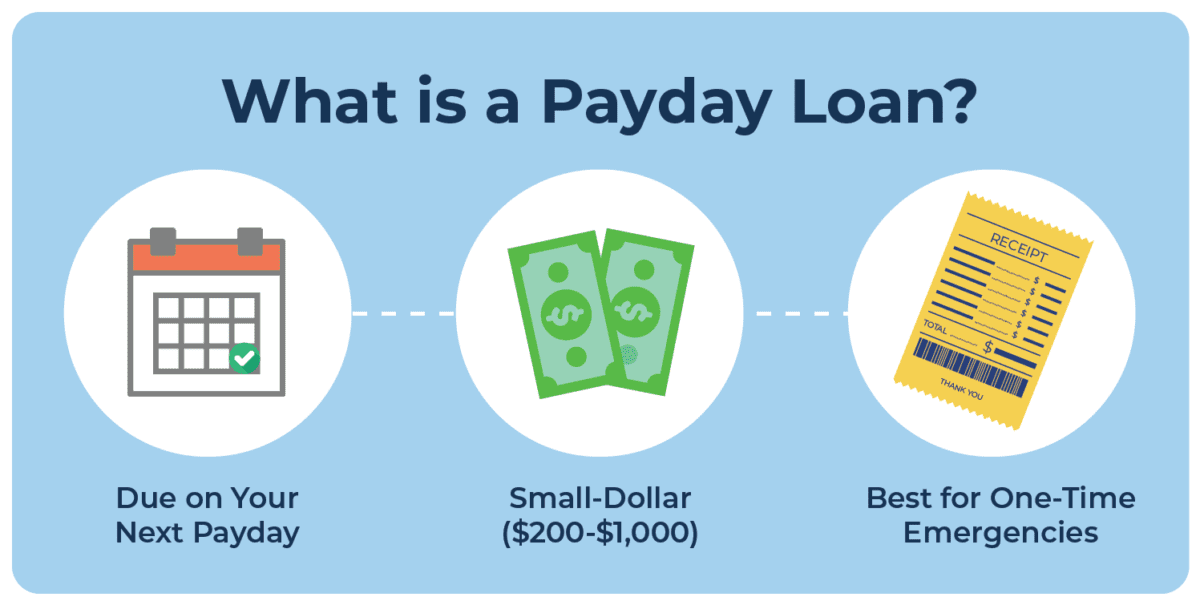

Since a personal loan is known as a “payday loan” if it provides money on the foundation of a person’s paycheck alone, numerous financing organizations fall under this sounding loan. They can’t all be bad, and they are not. What exactly is bad is the way they’re sometimes utilized by borrowers. That is very good news, as it means you can make use of a personal loan of the nature responsibly. You can certainly do it without stepping into future difficulty, and without switching a one-time loan into a monthly responsibility.

The trustworthiness of a payday loan lender is very important. You can find free online learning resources online had been you are able to review and compare many different loan providers. Take the time to search and compare payday loan organizations, it may save countless hassle as time goes on.